FINANCING MUD ACTIVITIES

As political subdivisions of the state of Texas charged with providing a variety of services to residents and businesses, Municipal Utility Districts (MUDs) are one of the most highly regulated governmental entities. MUD operations are overseen by the Texas Commission on Environmental Quality (TCEQ) and the U.S. Environmental Protection Agency (EPA), and must be conducted in accordance with other applicable state, federal and local laws.

In particular, financing for MUDs is regulated by TCEQ, the U.S. Securities and Exchange Commission (SEC) and the Internal Revenue Service (IRS).

In order to establish and maintain services for residents and businesses, Municipal Utility Districts rely on two sources of revenue:

- Monthly service fees

- Property taxes

Monthly Service Fees

Service fees that are collected each month enable MUD 127 (“the District”) to pay for adequate drinking water (supplied via WHCRWA), wastewater treatment, solid waste services, and other day-to-day operations of the District.

A breakdown of monthly service fees is detailed in the MUD 127 Rate Order, linked below. H2O Consulting, the current operator for the District, handles the billing and payment processing for monthly service fees, as explained here.

Property Taxes

A significant number of sophisticated electrical and mechanical systems are required for the round-the-clock operations that provide the water services we expect when we turn on a faucet or flush a toilet. Revenue from property taxes enables the District to fund more costly maintenance and capital improvement projects for these systems. Property tax revenues are allocated for two types of expenses: Maintenance and Debt Service.

Maintenance Costs

Typical maintenance costs include the following:

- Regular testing for water well performance, generator load, and biological monitoring.

- Repairs to items such as chemical feed controls, automatic transfer switches for emergency power during electrical outages, and security alarm wiring.

- Replacement of equipment parts such as circuit boards, vibration sensors, measuring units, and gear drives.

Debt Service

Financing major projects for the repair, replacement and upgrade of infrastructure requires the issuance of bonds and the payment of debt service. Examples of these major projects include:

- Rehabilitation and reinforcement of aging sewer lines

- Recoating water tanks and steel basins in the wastewater treatment plant

- Water well cleaning and water well pump rehabilitation

- Upgrades to the security and motor control systems.

The most effective way to pay for these projects is by selling long-term, tax-exempt bonds. Financing the expense of these projects through tax-exempt bonds spreads the cost over the useful life of the system components and allows all property owners to pay their fair share. The bonds are sold in the open market at competitive bid, and the District can capture the lowest possible interest rates (which, through 2019, remain at historically low levels). The alternative to selling bonds would be to require all current residents to pay substantially higher monthly service fees to generate the cash needed for major project costs.

Over the years, MUD 127 has issued four series of bonds — in 1984, 2004, 2009 and 2015 in the total amount of $18,295,000. The current outstanding debt of $10,390,800 will be paid off in 2031.

Tax Rates

Annual tax rates are determined based on several factors, including the anticipated expense required to ensure infrastructure integrity and reliable service delivery, and the anticipated tax revenue from the properties within the District. Taxes are levied once the annually assessed valuation of the property located within the District has been certified by the Harris County Appraisal District (HCAD).

MUD 127 boundaries were established in 1975. Until the early 2000’s, there were fewer than 600 single-family residences, or “connections,” within the District’s 379 acres. Since 2002, the land within the District has continued to be developed, and annexation of additional tracts has occurred. As of 2021, MUD 127 encompasses 519 acres and approximately 2,640 connections.

The additional connections have added both to the scope of MUD 127 operations and the property tax base. These conditions, plus consideration of the District’s financial health and the fact that property values may fluctuate from year to year, feed into the deliberation of annual tax rates set by the Board of Directors.

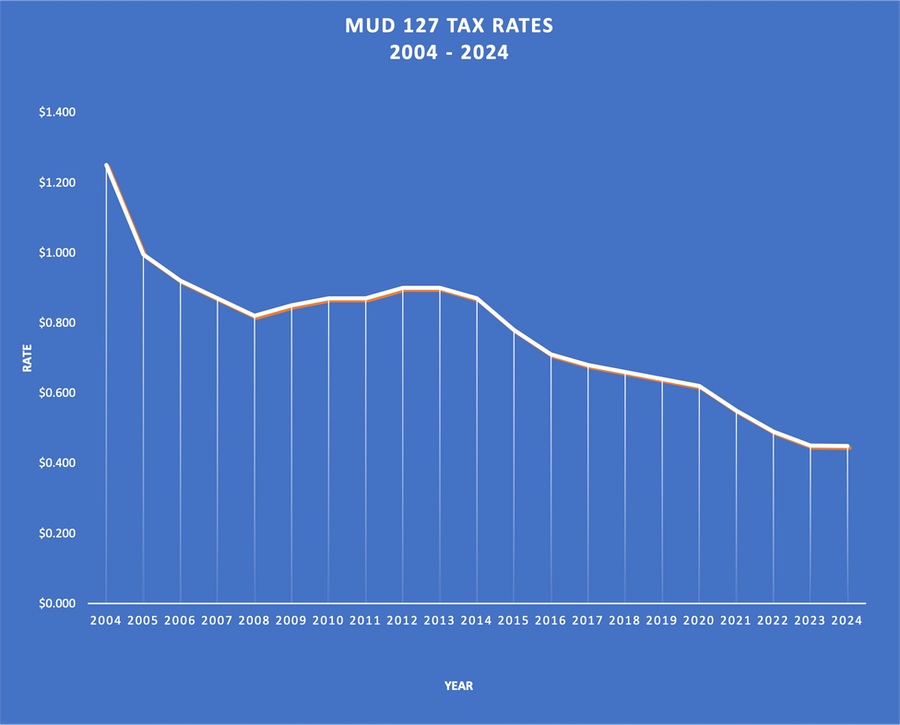

The 2024 tax rate is $0.449 per $100 of assessed valuation, with $0.27 allocated for maintenance costs and $0.179 designated for debt service. The graph below illustrates how the tax rate has changed annually from the year 2004 to 2024.

Maintenance tax revenue is deposited to the District’s General Operating Fund and is used for operations maintenance expense. Debt service tax revenue is deposited in the Debt Service Fund and is used to make payments on the District’s bonds. Equi Tax Incorporated is the firm currently charged with billing and collecting property taxes for the District.

Assessment of Financial Health

In matters related to the setting of tax rates and the issuance of bonds, the MUD 127 Board of Directors is advised by Rathmann & Associates LP, a firm whose principals have 35-plus years specializing in financial consulting for municipal utility districts.

According to the assessment of Rathmann & Associates, the District is in excellent financial condition. At the end of 2020 there is a balance in the General Fund equal to more than 300% of annual budgeted expenditures. This allows the District to pay for major repairs and improvements to the system without borrowing additional money. In the Debt Service Fund, the balance is approximately 100% of the next year’s payments. This healthy position allows the District to levy lower tax rates each year for debt.

The District has a “BBB+” bond rating from Standard & Poor’s, which is an investment grade rating that indicates the District’s very strong financial position. The BBB+ rating qualifies for bond insurance, which reduces the interest rate on the bonds. The District maintained its strong financial position in the face of the 2008 recession and loss of property values. In addition, the District has refinanced its existing bonds three times to reduce the interest costs.

Budgets & Audits

The District establishes and maintains annual budgets for its operations. Revenues and expenses are tracked by MUD 127’s bookkeeper, District Data Services, and are reviewed closely by the Board of Directors at each monthly meeting. The Board is careful to maintain sufficient fund balances to be able to pay for large repairs if they are needed.

Each year, the District’s books are audited by an independent auditor (currently the firm of Mark C. Eyring, CPA, PLLC). The audit report is filed with the appropriate regulatory agencies and available upon request to the public.

UPCOMING MEETINGS

Monday, April 21, 2025 at 12:00 PM

Meeting Location:

18880 Gummert Road, Katy, Texas 77449

Monday, May 12, 2025 at 12:00 PM

The District’s Board of Directors generally meets on the second Monday of the month at noon at the office of Strawn & Richardson, 1155 Dairy Ashford, Suite 875, Houston, Texas 77079.

Meeting agendas are posted one week in advance of meetings.